|

Bruce Harington |

The healthcare sector, and biotechnology in particular, performed strongly in June (MSCI World Healthcare Index +6.7%, Nasdaq Biotech Index +9.2%) with one reason being the announcement of a few large M&A deals. Specifically Pfizer bought oncology-focused Array Biopharma for $11bn (a premium of 62%) and AbbVie bought Allergan, the company behind Botox, for $63bn (a 45% premium).

M&A is a consistent theme in the healthcare sector. The reason for this is because big pharma and big biotech businesses are on a constant treadmill where they need to find new drugs in order to replace

lost revenue from drugs going off patent. Some of the lost revenue can be replaced by drugs developed internally, but increasingly big biopharma businesses are having to turn to M&A as the key way in which they replenish their drug portfolios. This is because the most promising, cutting edge innovation is happening at smaller companies and not within big pharma or big biotech. Big pharma and big biotech simply do not have the entrepreneurial cultures or incentives required to attract the best innovation talent. A top scientist working on an attractive new drug technology will earn far more from developing the drug independently versus doing so working within big pharma. R&D productivity at big pharma has been very poor. A study by Deloitte found that return on investment from R&D at the 12 largest big pharma businesses was just 1.9% in 2018, a 9 year low. It was not much better in 2017 at 3.2%. Big pharma can, however, offer global sales and distribution networks which allow them to acquire new drugs and instantly reach a large universe of doctors and patients.

Anticipating M&A is one of the key tools that the managers within Stenham Healthcare use to generate alpha. When selecting stocks for their portfolios the strategic value of the products or pipeline to a large pharma acquirer is key to their analysis. Given their knowledge of drug innovation and the existing universe of available treatments they tend to be very good at identifying acquisition targets. In June, Stenham Healthcare had three managers who owned Array and two who owned Allergan. This level of participation in M&A deals, while good, is not totally unusual. There are typically always at least one or two managers in the fund who own the target whenever an M&A transaction is announced. Given the focus on M&A as a core piece of the investment approach, it is actually very rare for none of the managers to have exposure to a target.

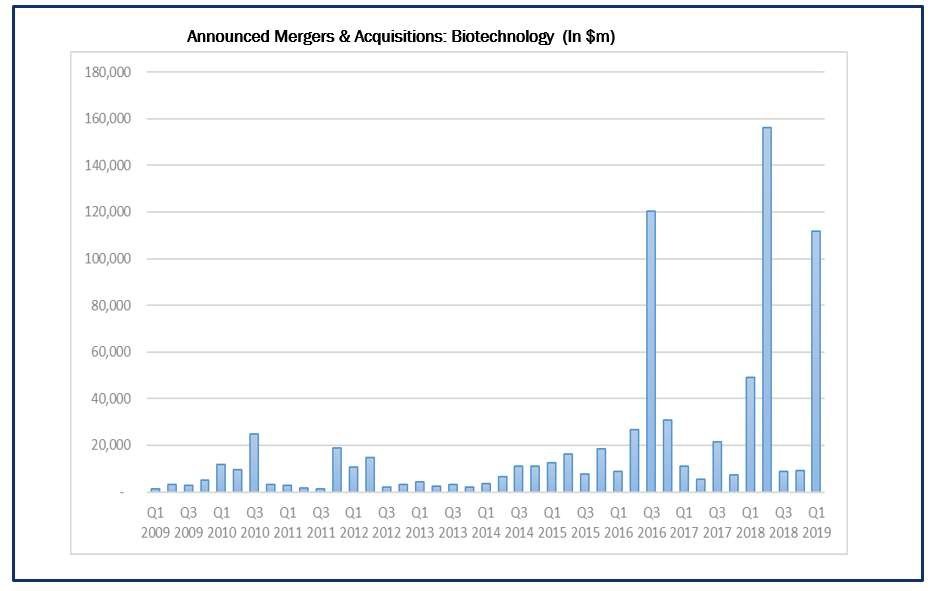

As you can see from the graph (source: Bloomberg), M&A volumes are lumpy. There will not be M&A deals every month and there can be extended periods with low activity.

|

|

Structurally, however, there is definitely an upwards trend in M&A volumes due to increased innovation and the fact that most of that innovation is occurring outside of big pharma and big biotech. We expect Stenham Healthcare will continue to have a good level of exposure to innovative biopharma stocks which are taken out in the future.