For over 30 years our investment philosophy has remained unchanged. We strive to deliver stable and decorrelated returns to our investors by minimising downside risk. We only invest in what we fundamentally understand and favour liquid and transparent strategies.

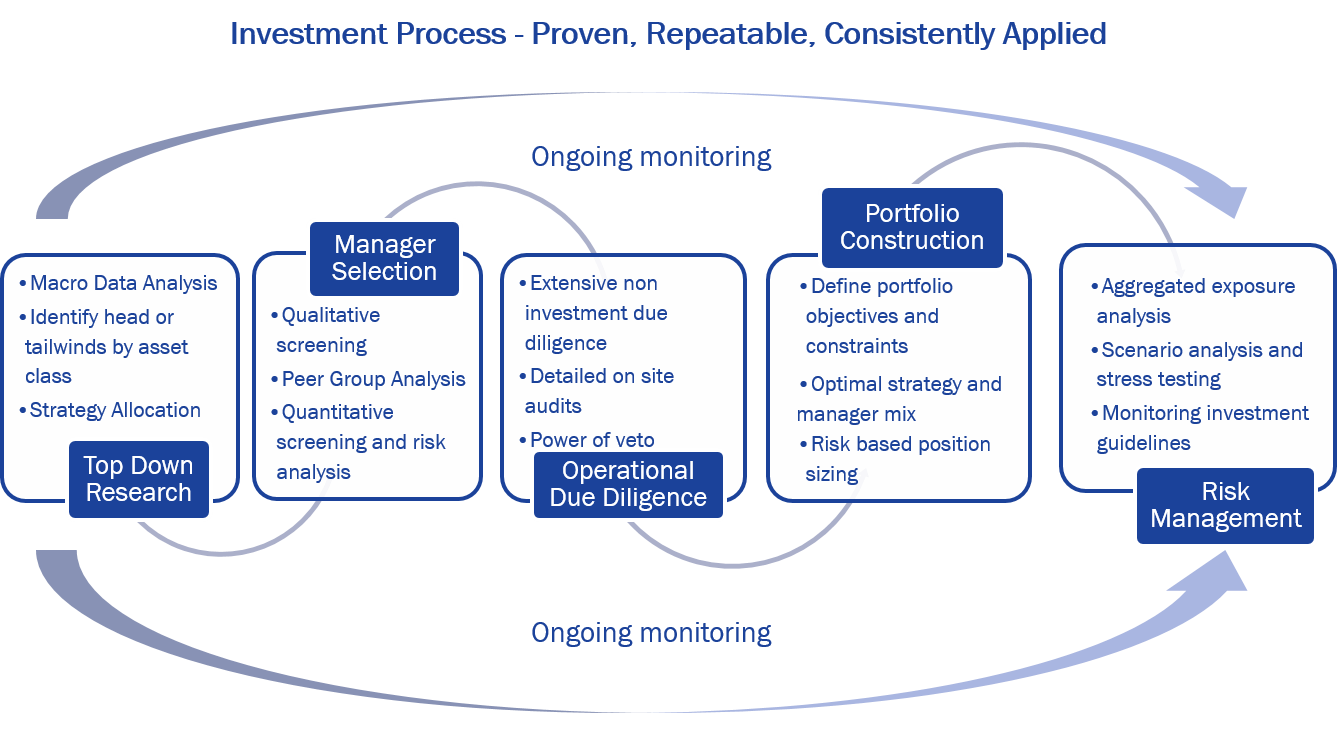

While our philosophy remains unchanged, our investment process has evolved over time to ensure we have a robust and institutional process that investors can be confident is sustainable and repeatable.

Quantitative and qualitative techniques are combined with detailed due diligence to get a full understanding of risk at both the underlying fund level and portfolio level. Emphasis is placed on managing risk by diversifying geographically using non-correlated strategies.

We believe that no single manager can excel in all investment arenas. Accordingly our investment process is based on accessing the expertise of the best managers globally. These managers invest in a range of assets, capital instruments, markets, strategies and geographical areas, capturing positive returns through their individual skills. Investors’ capital is allocated to these carefully selected independent investment managers and then blended together as a portfolio to achieve consistent superior returns with low volatility. Each manager represents ’best of breed’ in a particular area.