Stenham Trading

30th Anniversary

We are delighted to be celebrating the 30th anniversary of Stenham Trading.

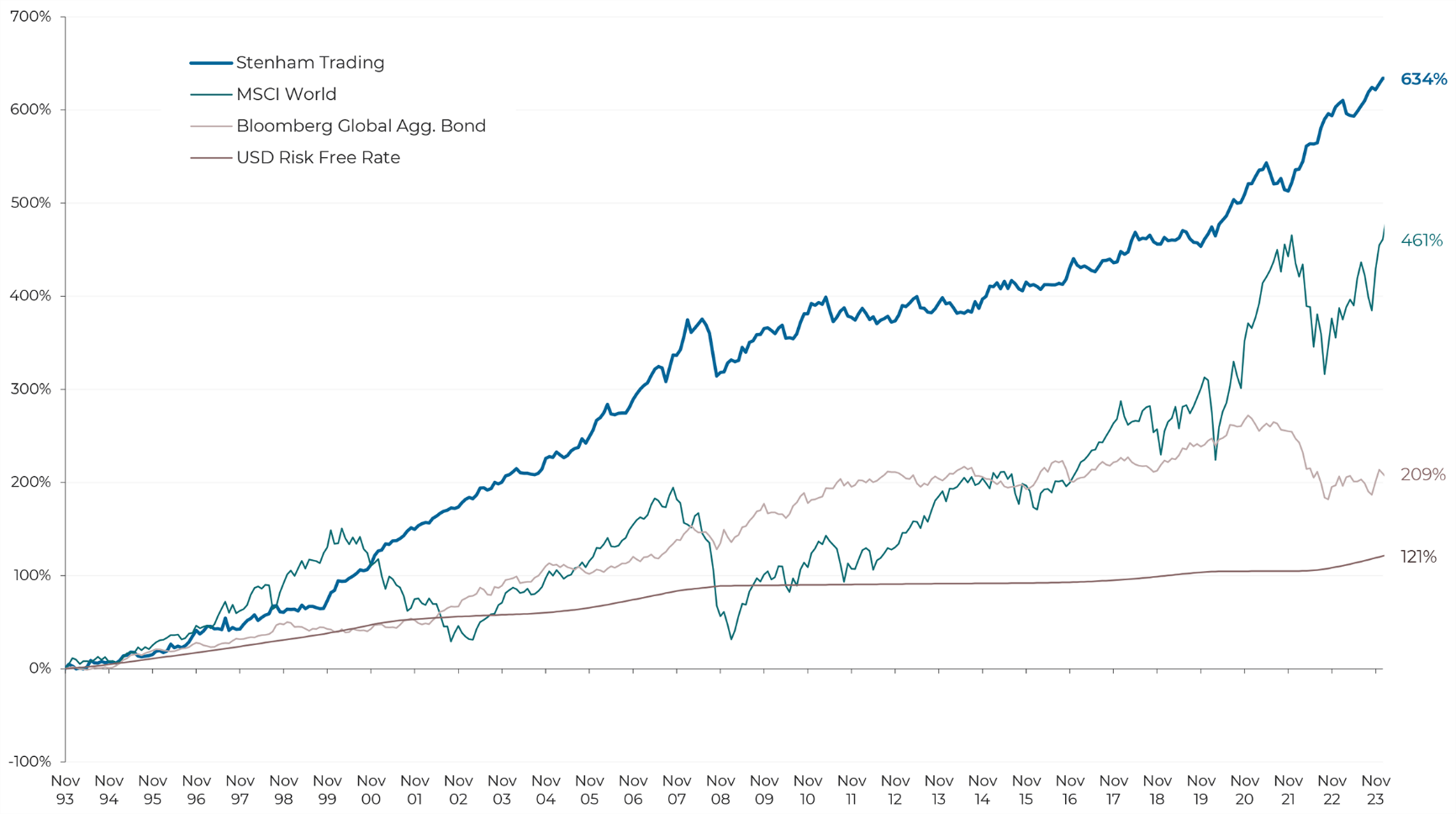

We launched the Fund in December 1993 to invest primarily in discretionary global macro strategies. The objective was to compound growth whilst delivering returns uncorrelated to equities and bonds, and preserving capital in more challenging market environments. Annualising at 7% over the past three decades, in excess of cash, equities and bonds, we can safely say the Fund has achieved this objective.

Cumulative Return (1 Dec 1993 - 30 Nov 2023)*

* Reflects returns net of 1.5% management fee. Past performance is not a reliable indicator of future results. Source: Stenham Asset Management, Bloomberg.

We believe the current roster of managers in the Fund is arguably one of the best vintages in its history.

We have been tested through various market crises (1998 LTCM blow up, dot-com bubble, 9/11, 2008 financial crisis and, more recently, Covid) and the Fund has stood the test of time. We are proud that we have never had exposure to any blow-ups, and we have never “gated” or suspended redemptions for any of our portfolios, even while, at times, being used by clients for liquidity needs. We have managed to prevent large drawdowns and generate returns with very low volatility.

Post-financial crisis (2009-2019) was a difficult period for global macro and trading strategies. Actions taken by central banks, such as quantitative easing, were successful in suppressing market volatility and limiting price discovery. There were fewer trading opportunities, particularly in fixed income and currency markets which tend to be the go-to assets for macro managers. It is important to highlight that Stenham Trading was able to generate positive bond-like returns in this more challenging environment. Even during this more fallow period for the strategy, the Fund was able to outperform traditional assets in more volatile environments, such as 2018, or during events such as Brexit and the 2016 Trump election.

Since Covid, we have seen a normalisation of market volatility. We believe the post-financial crisis period might well, in time, be seen as the aberration. Studying macro variables, such as inflation, growth, employment and assessing whether monetary policy is appropriate or not, appears to matter after all, as it has for several decades. It is no surprise that our returns have rebounded during this period with the Fund posting double-digit returns in 2020 and 2022. In fact, 2022, which was one of the worst years for financial assets, saw the Fund deliver its best returns in two decades, highlighting the strong diversification properties.

We continue to run the Fund today with the same principles as when we launched in 1993. Focusing on identifying the best managers, preserving capital in challenging periods and avoiding left-tail risks, we believe, is the optimal way to compound growth over time. Over the three decades, we have invested with various generations of macro managers and seen the baton pass from one to the next. As information has become commoditised, structuring of trades and portfolios has become increasingly important to deliver asymmetric returns. We believe the current roster of managers in the Fund is arguably one of the best vintages in its history.

The opportunity set for our Fund and managers looks highly attractive from our vantage point. There are numerous unanswered questions in global markets, including whether inflation has peaked, whether we see monetary policy changes in Japan, the impact of a slowing Chinese economy, and growing political uncertainty as we head into an active election calendar. We also believe the world today stands at the precipice of many changes which could lead to a sustained rise in market volatility. If globalisation brought economic prosperity, peace, and low inflation, it could well be the case that deglobalisation leads to the opposite outcome.

We believe it is imperative for asset owners to run a diversified portfolio in the face of this uncertainty. An allocation to global macro can provide attractive returns in excess of cash rates, with very limited volatility and correlation to asset markets. Over the years, an allocation to Stenham Trading has helped boost returns and reduce risk when blended to a traditional 60/40 asset allocation framework.

From a business perspective, we continue to see strong interest in this strategy, especially from sophisticated investors who realise the value of uncorrelated returns. We have seen the Fund’s assets double in the past few years. Stenham Trading provides exposure to some of the highest-calibre global macro managers, many of whom are closed to new investors, thus offering preferential capacity. Institutions recognise the need for a diversified basket of global macro funds for the strategy to achieve its objective, and having an investment with just 1 or 2 managers may not work, as dispersion in returns can be high.

Stenham is one of the most experienced investors in global macro globally. Our quantum of assets invested in the space, breadth of relationships and coverage of the broader peer group is unique. We continue to believe that the strategy once employed by hedge fund industry legends, including George Soros, Stan Druckenmiller, Paul Tudor Jones, Alan Howard and Louis Bacon, is in safe hands with the next generation of macro traders. The strategy is as relevant today, if not more so than it has been historically.

We thank you for your support over the years and we look forward to working with you now and in the future. Please feel free to contact either of us, or your Stenham representative, should you have any questions or if you need more information.